Financial literacy is crucial for financial empowerment, but research indicates many young people still struggle to acquire this vital knowledge.

Forty percent of college students lack adequate financial literacy knowledge and skills, and 74% of teens say they don’t feel confident about their personal financial knowledge. These figures aren’t entirely surprising. Though financial information is more accessible than ever, knowing where to get trustworthy information is difficult.

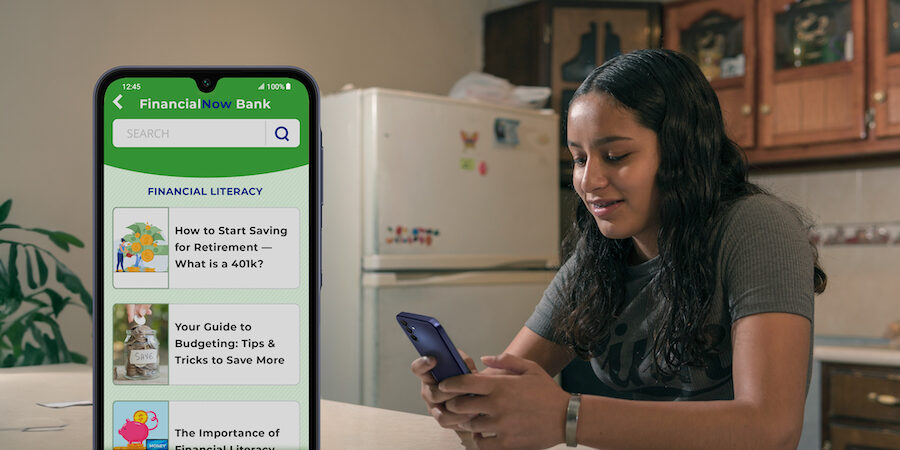

Banks can play a critical role in closing this knowledge gap and advancing financial literacy for the younger generation, using smartphones and mobile apps to put financial knowledge at their fingertips. These technologies have become integral in the lives of this digitally savvy generation — 95% of teens have a smartphone and more than half of them have been using the device since they were 11 years old.

By meeting this demographic where they are, with the tools they’re accustomed to using, banks can give them the confidence to build a solid financial foundation.

Why is financial literacy important for students?

It’s often said knowledge is power. This is especially true when it comes to personal finance.

So, what is financial literacy for students, and why is it important? Financial literacy gives students the knowledge and power to make better financial decisions. It helps them understand key financial concepts related to budgeting, saving and investing. It allows them to navigate different financial situations effectively, such as choosing between student loans, comparing credit cards, and whether they can handle the interest payments.

Financial literacy can adequately prepare young people for future financial responsibilities, including managing monthly bills, buying their first home or saving for retirement. This knowledge also can help them overcome financial challenges. TIAA Institute research indicates limited financial literacy skills have made millennials unprepared for a major financial crisis. Its research indicates that “millennials show alarmingly low financial literacy levels,” as only 16% could answer questions correctly about three basic personal finance concepts: interest rates, inflation and risk diversification.

Increasing financial literacy can cultivate money management skills that lay the groundwork for long-term financial stability. As young people navigate their financial lives, they’ll need guidance to help them develop these skills. Banks can offer this by equipping parents and their children with tools to set them on a solid financial path.

How banks can address financial knowledge gaps

Providing financial education to young people can help banks better serve this demographic and build long-term loyalty and trust with younger customers. Banks that establish early relationships with customers often benefit from higher long-term loyalty and customer lifetime value, according to Bain & Company’s Customer Behavior and Loyalty in Banking report.

Many banks already provide student-friendly, low-fee products, such as savings and checking accounts, that help younger generations embark on their financial journey.

However, they can leverage technology to help them scale these efforts. Through mobile apps and tools, they can offer budgeting calculators, savings goal trackers, and interactive lessons on the most relevant financial topics for younger audiences, such as navigating college loans or buying their first car.

Banks can also empower parents to help their children. They can partner with a technology provider to offer smartphones and digital financial education solutions for parents who add kids to their accounts or open a dedicated account for their children.

Custom apps preloaded on each device can serve as a starting point to build financial knowledge. Banks can configure each device with educational finance games and tools and kid-friendly features, including those that allow them to manage their allowance and chores, manage payments for completed chores, set savings goals, track their spending, and access an account summary. A study by the National Endowment for Financial Education (NEFE) indicates that 88% of parents believe financial education is crucial for children. However, only 26 states in the U.S. mandate personal finance courses in high schools. Banks can help bridge these financial knowledge gaps by providing the right tools.

Banks can also provide a separate interface for parents to set up an allowance, add chores, review financial lessons, and access more financial advice to learn additional ways to support their child’s financial education. Even better, parents and kids can handle all these tasks securely. To equip users with the tools necessary for building a secure financial future, apps incorporate robust security features to safeguard data, along with parental controls that enable the setting of spending limits.

New revenue streams can be generated through these products, allowing for effective upselling and cross-selling of additional services such as joint accounts, trusts, and 529 college savings plans. By providing digital financial tools, banks can foster and strengthen lasting relationships with younger customers, evolving alongside them as they transition through different life stages and seek various financial solutions.

Putting students on the right financial path

Though many students lack financial literacy, there’s an opportunity for banks to provide guidance and knowledge that builds their financial confidence. By using smartphones, mobile apps and other digital tools, banks can expand access to financial education for this generation, allowing them to build trusted, long-term relationships that expand their customer base.

Interested in learning about Samsung’s solutions for the financial services industry? Contact your account manager or request to speak to an industry expert.

Sign up for our newsletter, INSIGHTS: Banking, a monthly update from Samsung on banking trends and technology’s role in the financial services industry.