Although many companies have encouraged employees to return to the office, hybrid working remains comparatively prevalent in the financial services sector. According to Gartner, 8% of general knowledge workers and 16% of high performing employees in financial services are less likely to stay if on-site mandates are implemented.

At the same time, financial services firms face increasing banking cybersecurity threats. According to a report from the International Monetary Fund (IMF), attacks on financial institutions make up nearly one-fifth of all cyberattacks, with banks being the most vulnerable targets.

Remote security monitoring can help banks continue offering remote and hybrid workplace support — which has been proven to increase employee engagement and well-being — while improving banking cybersecurity. Here’s how.

The banking workplace is hybrid, flexible and at increased risk

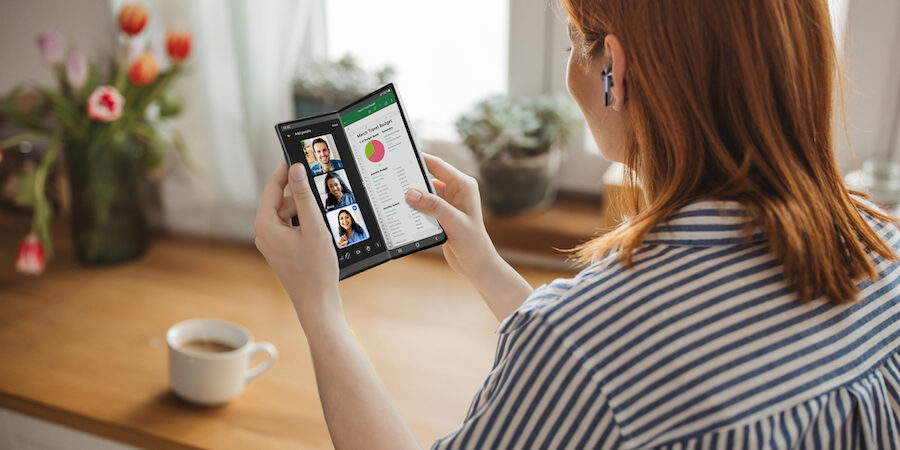

The very nature of how banking employees get their work done has significantly changed in recent years. From loan officers to claims adjusters, banking professionals need flexible access to critical systems and data from anywhere — whether meeting clients at coffee shops, working from home or traveling between branch locations.

Although mobile and remote connectivity has made bank workforces more productive, it also poses challenges. Banking staff must securely access customer records, process sensitive transactions, and handle confidential data across multiple locations and devices. Banks face increased risk when employees work remotely in the field with limited access to in-person IT support. According to the 2024 Verizon Data Breach Investigations Report (DBIR), non-malicious human factors, such as someone falling for a social engineering attack or making an error, contribute to 68% of total breaches.

IT teams struggle to balance supporting remote employee productivity with ensuring proper security and compliance. The stakes are especially high given the relentless cyber threats facing the financial services sector, the sensitive nature of financial data, and the regulatory requirements governing its protection. According to IBM’s Cost of a Data Breach Report 2024, financial services firms face an average cost of $6.08 million per breach. Banks need robust solutions that protect sensitive data while enabling productive remote work.

How remote security monitoring strengthens banking cybersecurity

Rapid response is crucial to preventing the worst outcomes of a security incident. According to IBM, data breaches that lasted more than 200 days had the highest average cost, at $5.46 million, compared to breaches that took fewer than 200 days to contain. Remote security monitoring provides financial services firms with the capabilities required for quick detection and response so IT teams can identify and address potential threats before they escalate.

Remote monitoring solutions allow banking IT teams to support employees wherever they work while maintaining security. For instance, when a loan officer at a client site encounters issues accessing secure banking systems during a critical meeting, they can immediately connect with IT support. The support team can view the loan officer’s screen, troubleshoot authentication issues, and ensure swift access to customer financial records so the meeting can proceed.

IT teams can also proactively monitor security concerns across all banking devices. If suspicious activity is detected on a claims adjuster’s laptop in the field, IT professionals can initiate a remote session to investigate potential security issues before they impact sensitive customer data. They can document any concerning behavior through screen captures and session recordings, creating an audit trail that helps maintain regulatory compliance.

Remote monitoring creates a sustainable foundation for hybrid work. By enabling secure remote and mobile access while maintaining robust security controls, banks can continue providing the flexible work arrangements that employees value while meeting their obligations to protect customers’ financial data and transactions.

Balancing hybrid work and security

Banks must be responsive to employees who value workplace flexibility as well as the serious cyber threats targeting hybrid work environments. Remote security monitoring helps balance these twin priorities, delivering the tools to protect sensitive data while enabling productive remote and mobile work.

Learn how Samsung Knox Asset Intelligence and Security Center helps monitor devices remotely and prevent security incidents. And sign up for our newsletter, INSIGHTS: Banking & Insurance, a monthly update on banking trends and technology’s role in the financial services industry.