There’s a lot to love about working for yourself — the freedom and flexibility, being your own boss and having the opportunity to tap into your passions and bring your vision to life. But most people don’t love small business and freelancer financial management. Bookkeeping and invoicing can be time-consuming, and do-it-yourself accounting can get you into tax trouble if you don’t fully understand all the relevant regulations and processes.

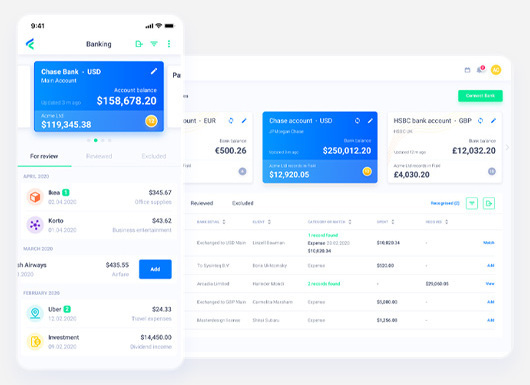

Enter Fiskl — an intelligent finance manager that combines invoices, payments, expenses, banking, quotes and timekeeping into one easy-to-use mobile app.

“We built Fiskl for business owners and freelancers, not for accountants,” says Alina Lapusneanu, co-founder and CEO of Fiskl. “It’s very easy and intuitive to use, and business owners can see everything their teams log, in real time. If they need to issue an invoice, they’ve got all the elements they need — everything their employees are tracking — right on their phone, so they can invoice from anywhere.”

Since the app launched two years ago, Fiskl has expanded its global client base to more than 52,000 customers across 120 countries. Now the demand is even greater for mobile-first financial management solutions, due to the shift to remote work and the ever-growing gig economy. Already, 36 percent of the U.S. workforce participates in the gig economy as a primary or secondary job, according to a 2018 Gallup poll, and 29 percent have an “alternative work arrangement” for their primary job.

The Fiskl story

The seed for the app was planted back in 2016, during a conversation between Lapusneanu and Fiskl co-founder Shawn Vader, who was then a software architect consulting for a large bank.

“He was struggling with invoicing the bank and keeping track of everything,” Lapusneanu recalls. “He would have to look at his calendar, find his receipts and do the process manually. I come from a mobile background, and we realized that this was a problem for lots of people — consultants, freelancers, small business owners who needed a way to keep track of receipts and easily invoice clients, ideally without having to be in front of their laptops.”

Lapusneanu and Vader spent the next six months interviewing people from these groups and talking to “literally anybody who visited [their] homes doing some kind of job,” asking about their current solutions and their pain points with those solutions. It turned out that while some business owners were using spreadsheets or even paper documents, others were using sophisticated tools with more bells and whistles than they really needed.

“We tested one popular solution and took it all the way from setup to issuing the first invoice,” says Lapusneanu. “It took two hours, and he’s a software specialist and I have an MBA in finance. It shouldn’t take that long to learn how to send an invoice.”

So, they took their personal experiences and founder frustrations, along with their customer feedback and market research, and built the first version of the platform for U.K. companies. Within a year, they had over 5,000 customers and requests from all over the world to use the solution. A year later, they launched a global version of the app and watched it take off from there.

How it works

Whether you work alone or have a small team, there’s lots of information you need to keep track of in order to invoice customers, provide quotes for prospects and ensure tax compliance. Fiskl puts all that important data in one place so you can automate important tasks.

For example, Fiskl automates expense tracking by extracting data instantly from your phone so you don’t have to scan receipts. Then, the intelligent system suggests how to categorize each transaction for tax purposes and gives you a chance to approve or change that categorization. The mobile-first platform also includes time tracking, mileage tracking integrated with Google Maps, and online and mobile payment options via integrations with Paypal, Stripe, WePay and Google Pay.

“With the payment integrations, when you create an invoice, you can select a payment gateway or multiple payment gateways,” Lapusneanu explains. “Then the customer can pay by clicking on the link on the invoice and choosing a third-party payment app or just entering their credit card information.”

Lapusneanu says the ability to get paid remotely is particularly important now, as people look for safer, more convenient ways to pay. In March 2020, the number of online payments processed through Fiskl jumped 150 percent. By late summer, it was up 300 percent.

In July 2020, Fiskl introduced banking automation (starting with 6,000 banks worldwide and expanding to 11,000 in early 2021). These integrations let you connect your bank account to the app, which then automatically brings in transaction data so you can quickly and easily reconcile invoices with payments with banking transactions. As an added bonus, because of Fiskl’s relationship with financial institutions, the platform is required to have bank-level data security. That isn’t the case for most other invoicing solutions, Lapusneanu says.

What's next for the future of finance?

Samsung surveyed 1,000 finance professionals about the state of the industry. Here's what they said. Download Now

“Come January, we will be the only truly mobile accounting app for small businesses and freelancers. And the benefits for small businesses are ease of use and intuitiveness, but also visibility into their organizations’ cash flow and the ability to speed up that cash flow by processing invoices more quickly — anytime, from anywhere — and getting paid faster.”

Getting started with Fiskl

The solution was designed to be self-serve and easy to use, but Fiskl’s team keeps the lines of communication open with customers via Zoom sessions, online tips and resources, and one-on-one customer support.

“We recommend taking advantage of the sophistication of the invoicing feature to automate as much as possible by adding your bank,” Lapusneanu says. “That makes it much easier to get your year-end stuff ready because you have the full picture of your cash flow and a real-time overview of your business. By just connecting your bank and your favorite payment gateways, you’ll bring in all the invoices associated with those payments and your banking information, and suddenly 90 percent of your data is there. That gives you a very good head start, and you can come to us if you need any further help as you’re progressing towards accounting.”

Discover more essential apps to empower your growing business — and explore exclusive business pricing, financing and trade-in options and other deals on everything from phones and tablets to monitors and memory.