A newly released report on FinTech trends reveals that customers are flocking to FinTech firms, but overall trust in non-traditional financial services is low. According to the 2017 World FinTech Report by Capgemini, LinkedIn and Efma, more than 50 percent of banking survey respondents acknowledged using at least one non-traditional FinTech provider’s products and services, and 46 percent of customers acknowledge using a combination of at least three FinTech providers, which include a mix of both traditional and non-traditional firms. However, only 23.6 percent of customers trust their non-traditional FinTech providers.

The demographic data reveals that young, tech-savvy and affluent professionals exhibit the most trust in FinTech firms. Age also plays a role — millennials are the most trusting of FinTech providers, while baby boomers are the least. When customers have a positive experience with their FinTech firms, the trust factor spikes dramatically, rising to 56.3 percent.

To keep up with the competition, traditional firms have ramped up their FinTech efforts dramatically in just a year’s time. Mobile banking apps from JPMorgan Chase, Bank of America, Capital One and Wells Fargo rank among the top 10 U.S. banking and Fintech apps in July 2016 based on ratings. PayPal (including peer-to-peer payment app Venmo), Mint and Credit Karma round out the three most popular non-traditional FinTech apps. Although generally lacking in innovation, traditional firms score higher in fraud protection and transparency, two key concerns for FinTech customers that contribute to low confidence.

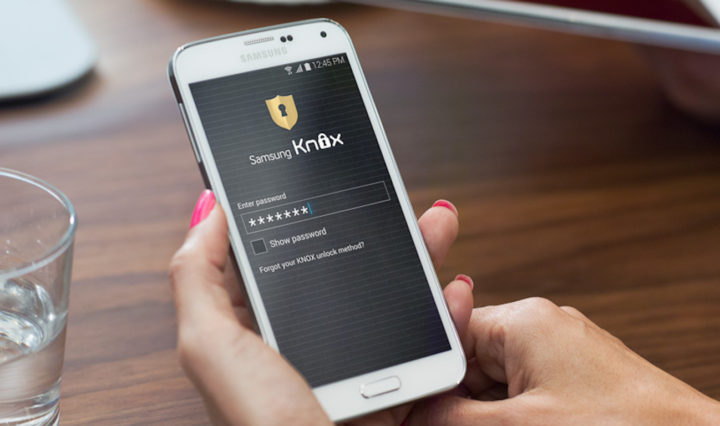

Making Android More Secure

This white paper explains why Samsung's Android devices are the most secure. Download Now

The Sum of All Fears: Identity Theft

Major traditional banking institutions are making strides to allay security issues like fraud and identity theft. For example, U.S. Bank is addressing security threats by implementing geolocation technology that pairs mobile location data with transactions to authenticate customer identity and authorize legitimate charges. Many firms are also using biometric technology, which allows them to make headway in identity-based authentication through unique personal identifiers, including fingerprint, face, eyes, ears, voice and even heartbeat scanning. PayPal has since introduced fingerprint authentication for more convenient customer access.

The latest FinTech data spells out the challenges ahead for both non-traditional and traditional FinTech firms — improve mobile banking security platforms and the customer experience without sacrificing convenience. As the Capgemini report revealed, positive user experience is the key to unlocking the trust factor and increasing customers’ confidence in their FinTech providers.

When using mobile banking apps, mobile security is crucial. Learn how Samsung Knox can provide defense-grade mobile security on all your Galaxy devices.