Self-service retail and hybrid delivery models were fast-growing trends even before COVID-19 — and they’ll remain popular after. Modern consumers expect a seamless shopping experience between online and in-store interactions, as well as more convenient ways to shop. Forward-thinking businesses have met those demands by offering contactless checkout, online ordering, local deliveries and curbside pickup — services that have quickly become standard.

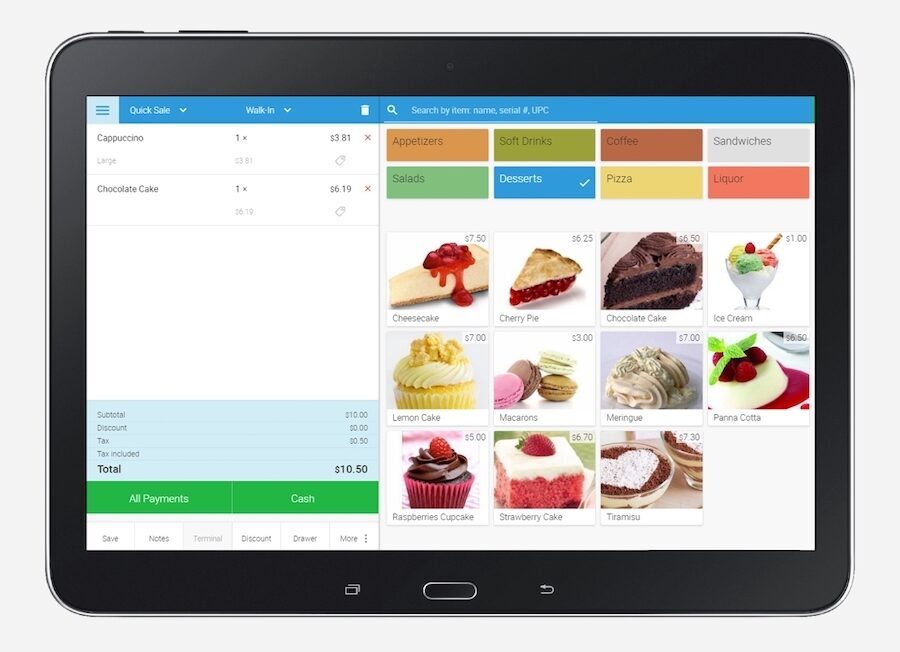

Some small merchants had already begun their digital transformation, adopting cloud-based point of sale (POS) solutions like eHopper to enable self-checkout, virtual payments and loyalty rewards programs. Other small retailers and restaurants are playing catch-up, ditching their old cash registers and manual processes in favor of mobile solutions and automated workflows — not just for the sake of innovation, but for increased ease, speed and safety as well.

Wherever you are on the digital transformation spectrum, eHopper can help. Its app-based POS solution is built specifically for small businesses and offers a new suite of features that will help you keep customers safe and satisfied.

The evolution of eHopper

eHopper was created in 2016 by its sister company, B2B Soft, a leading POS vendor for major wireless carriers. Many independent wireless retailers in these networks also own other types of shops or restaurants. When those entrepreneurs started inquiring about cloud-based POS solutions for small businesses, B2B Soft quickly realized there weren’t any available.

“Despite a lot of competition for retail point of sale, there was really no affordable, easy-to-use solution for small retailers,” says Vladimir Basin, eHopper’s general manager and head of product. “Even mom-and-pops needed to invest $20,000 to $25,000 in hardware and learn complicated systems. So we created an easy-to-use POS solution that works on any device. You just download the app, create an account, enter your products, activate your credit card processor and start ringing up sales in days instead of weeks.”

eHopper launched with five core components: payment processing, inventory management, customer relationship management (CRM), employee management and data reporting. Soon, they were asked to incorporate features such as online ordering, mobile pay, loyalty programs and self-serve functionality.

Contactless for customer safety

For safety and convenience alike, contactless service is now a top tech trend. eHopper has already added digital menu functionality that lets customers scan a QR code to view a restaurant’s menu, then order and pay — all directly from their smartphones. Now, eHopper is developing a QR-based solution that lets retail customers scan and pay for in-store merchandise with their phones.

eHopper’s solution includes other features, such as e-commerce, online ordering and contactless payment options like mobile pay. Merchants can even use the solution to create self-serve ordering stations in restaurant or self-checkout stations in retail shops.

“Businesses can install the app on a tablet and put it in kiosk mode, so customers have fewer face-to-face interactions with merchants,” explains Basin. “That helps with social distancing and reduces the number of staff members on the premises, which lessens the safety risks and the payroll costs.”

Because eHopper is a cloud-based system, managers can access the reporting features from anywhere, including the comfort and safety of home.

Benefits of eHopper point of sale solution

eHopper’s value extends far beyond COVID-19. Even in normal times — or whatever “new normal” is on the way — your business can expect the following benefits:

Faster sales: You can get eHopper’s solution as an all-in-one mounted tablet with credit card reader, or you can download the app on multiple mobile devices. This way, waiters can place customer orders directly from their tables, rather than jotting down orders on paper and then entering them on a computer. With streamlined communication, the kitchen staff can start preparing orders without a hitch. And when the customer’s ready to pay, the waiter can print a ticket — or better yet, the customer can pay directly from their phone. Likewise, retail customer service reps can use tablets to check store inventory and even ring up small purchases, saving customers a trip to the checkout line. Retailers can also speed up sales by installing self-checkout stations.

Fraud detection: Traditional cash registers provide limited ability to trace sales, says Basin. “Cashiers just count the items being bought, ring up the sale, process the credit card and provide a receipt,” he explains. “With eHopper, every sale is mapped to an employee who processes the sale and also it tracks which items are being bought. Being able to trace sales helps to minimize fraud, which is critical.”

Greater accuracy: eHopper also minimizes the potential for human error. “Without an integrated payments system, cashiers typically enter data in the POS system and then manually process payments using the credit card terminal,” says Basin. “That creates the potential to double-enter certain items. With our system, the software is connected to the payment terminal, so there’s minimal opportunity for human error or double entry.”

What's the best tablet for your business?

Take this quick assessment to see which Samsung tablet would best support your business needs. Download Now

Scalability: Whether your small business has one, two or 200 stores, eHopper’s solution can support and connect them all. “We provide multistore, multiregister functionality, meaning that our system tracks sales across stores and provides inventory visibility and reporting across the stores. We also provide location-based taxes, so if a business has different stores with different taxation, the system knows that.”

Better customer experience: eHopper allows your staff to be more efficient and informed. The inventory management functionality helps you keep high-demand products in stock. And the CRM feature provides full visibility into individuals’ purchase history so you can personalize marketing messages. You can also use the solution to survey customers about their experience and offer loyalty rewards programs.

Cheaper credit card processing: eHopper provides merchant services, so you don’t need a third-party vendor for credit card payments. Your business can either pay a competitive processing fee, or you can take advantage of eHopper’s free cash discount surcharging program, which passes processing fees along to the customer. “If your customers are OK with it, it’s a nominal fee for them, but typically it’s a significant savings for the small business,” notes Basin. “If you process 50,000 cards a month, and the fees are typically 3 percent, you’d save about $1,200 a month.”

Getting started with eHopper

As soon as you sign up for eHopper and create an account, eHopper will send you a welcome email with onboarding instructions and complimentary video training sessions. You can also get one-on-one training, attend weekly webinars for additional information or call any time for phone support.

“We’ve put a lot of time and thought into best practices for launching for our product and integrating it into different workflows for different industries,” says Basin. “My best advice for a successful deployment is to follow the processes we outline in the onboarding materials, read the software guides for different features and functionality, train your employees and be open-minded as you’re adapting your current workflows. It’s always tempting to stick to the old tools we know, but this tool will ultimately make your life easier and optimize your business for the future.”

Discover more essential apps to empower your growing business — and explore exclusive business pricing, financing and trade-in options and other deals on everything from phones and tablets to monitors and memory.