As reported in Banking Exchange, more than six months after the deadline, chip-based card uptake is still relatively slow among U.S. merchants, despite the shift in fraud liability to businesses that are not compliant.

Though card issuers have been aggressive in sending out chip-based (or EMV) cards to consumers, many large merchants have yet to install the point-of-sale (POS) terminals that can accept the new cards, so they are still using less secure transactions with magnetic stripe cards (even though many cards now have both chip and magnetic stripe capabilities).

The switch to chip-based cards helps protect against fraud, as the secure computer chips validate the card’s authenticity, and also include a one-time use security code with every transaction, which makes it almost impossible to use chip payment data for card fraud. Yet, according to a CardHub EMV Adoption survey, 42 percent of retailers have yet to install chip-capable terminals in any of their stores, and 43 percent of the retailers who have been breached in the last five years have yet to install the terminals.

Though many consumers are still unaware of the difference in security between the two technologies, 44 percent of survey respondents who checked their credit report recently understand that chip cards offer better security than magnetic stripe cards, which are easily cloned. Yet according to the survey, 56 percent of respondents don’t care if a merchant’s POS terminal is chip-enabled.

Even among merchants that can accept both types of cards, most have yet to turn on the EMV capability. Citing figures from the EMV Migration Forum, Fox Business reports that only about 20 percent of merchants with chip-capable terminals have turned on the EMV feature, with merchants citing delays in certification and in installation of software as primary reasons for the delay. However, there are relatively simple, EMV-ready solutions that merchants can adopt quickly.

mPOS Offers Revenue Opportunities

Some merchants are resistant to installing upgraded terminals, often because they’re only considering the security aspect of the new devices and not the other advantages that new POS systems, particularly mobile POS (mPOS) devices, offer.

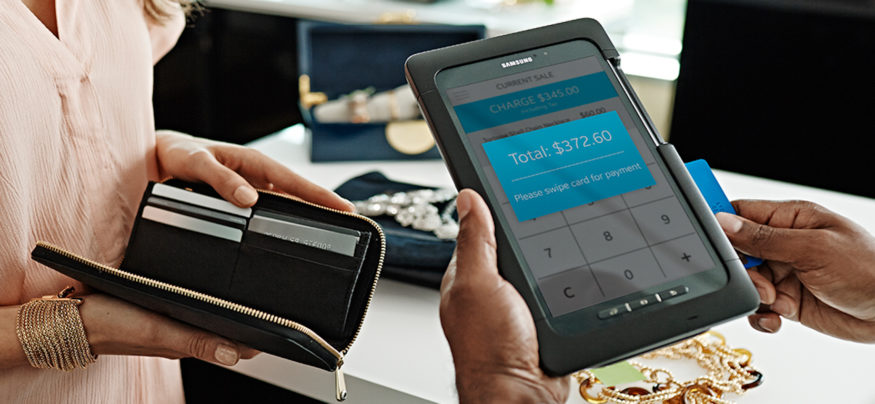

Built around intuitive, touch-screen tablets, mPOS solutions enable merchants to engage with customers in store aisles, as well as offering self-checkout, in-aisle checkout, e-receipts and virtual POS experiences. Using an mPOS device, a sales associate can meet a customer examining a product display to answer any questions or to process the sale immediately. Similarly, the tablets can be used to help sales associates provide “line busting” help during rush periods so that checkout lines don’t become too long.

Businesses can go a step further in providing merchant and customer convenience by adding contactless pay capabilities to their devices. Samsung Pay, a service available on the latest Samsung Galaxy smartphones, has expanded the reach of of mobile payments by utilizing both Near-Field Communications and Magnetic Secure Transmission technology, which works with most current POS terminals featuring a magnetic stripe reader. It also provides top-tier security for mobile payments using tokenization technology.

Despite the lag in retailers accepting chip-based cards, mPOS devices ensure security while also providing customers and sales associates with an engaging, streamlined experience.

For more information on mPOS and other retail technology, subscribe in the box to the right.