The holiday shopping season is well underway and on track to be the most mobile-influenced shopping event yet. Retailers that harness the benefits of mobile payments this holiday season are positioned to drive loyalty and repeat visits, and most importantly, earn coveted wallet share.

More than 151 million people across the US shopped either in stores and/or online over Black Friday weekend, according to the “Thanksgiving Weekend Survey,” released by the National Retail Federation (NRF), and conducted by Prosper Insights & Analytics. These shoppers are influencing the estimated $149.79 billion that companies will spend on “m-commerce” initiatives in 2019, as more shoppers leverage their smart devices to order products and services, especially the benefits of mobile payments, according to “US Mobile Payments Forecast: Driven by User Growth and Broader Acceptance, Transaction Value Will Triple in 2016,” a new report from eMarketer.

The Mobile Movement

These estimates may be three years out, but this holiday season is clearly setting the tone. For example, 63 percent of shoppers used their smartphones to make an online purchase over the holiday weekend, while 56 percent used it in store, according to the “2015 Eptica Retail Holiday Customer Experience Study.”

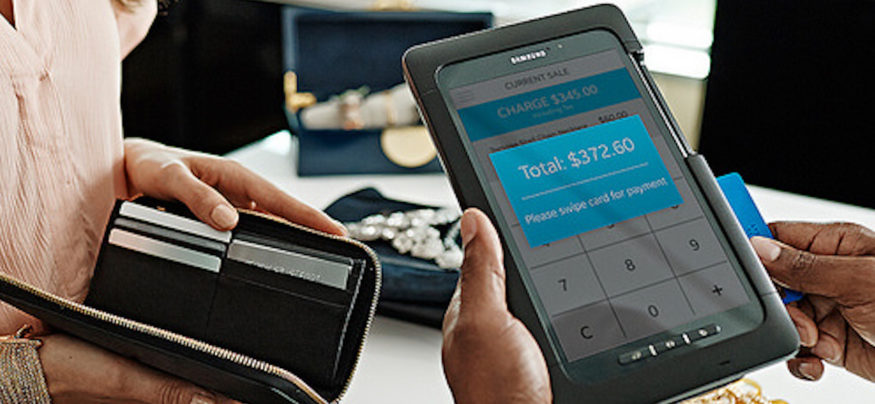

To ensure that retailers can continue to entice holiday shoppers, they must increase their levels of customer service. One way to do so is to highlight the benefits of mobile payments. Often called digital wallets, mobile payment platforms store users’ debit and credit card numbers, and enable consumers to pay for orders via their smartphones.

Industry pundits are so bullish on the benefits of mobile payments that they predict that mobile transaction value will triple in 2016, due to a growing user base, broader merchant acceptance and consumers increasingly using their phones to make point-of-sale (POS) payments on medium- and high-priced products, according to eMarketer’s report. Specifically, eMarketer anticipates that 2016 will be an inflection point for mobile payments in the US, with transaction value tripling to $27.05 billion.

Budding Benefits

In addition to being an innovative concept, the benefits of mobile payments are increasing. Among the biggest are their ability to:

- Streamline Payments. In our time-starved society, anything that can speed up the checkout process — especially payment tendering — is valuable to consumers and retailers alike. It helps consumers move through checkout and out the door faster, while enabling retailers to serve more shoppers without jeopardizing service. The 66 percent of companies that saved time through mobile payments saved a minimum of 150 hours annually, according to the “AT&T Small Business Technology Poll.”

- Bolster Loyalty Programs. Loyalty programs are a staple across the retail industry, but reliance on a physical card can become a hindrance. By integrating loyalty cards into mobile wallets, account information and access to stored information is instantaneous with the swipe of a mobile wallet. Earned loyalty points can also be stored — or redeemed — directly in the wallet.

- Improve Customer Engagement. While loyalty programs have been a “go-to” method of analyzing customer behavior and purchase correlations, mobility is stepping up efforts. In fact, mobile payments give companies access to customer-specific information, such as preferred payment account, product choices and visit frequency — all details that can be merged with marketing messages targeting specific merchandise to individual shoppers.

- Secure Information. Mobility appeals to shoppers’ sense of ease, but it also appeals to a new wave of hackers. More than 5 billion Android mobile apps, including mobile payment apps, are vulnerable to remote manipulation, according to Verizon’s “2015 Data Breach Investigations Report.” As a result, retailers should integrate innovations, including geo-location and customer validation, at the device and host levels to validate every step of the transaction and the environment.

Options Abound

More retailers are preparing to support seamless user experiences, as well as accept more options, with every POS payment terminal upgrade. New players, such as Android Pay, American Express Checkout and MasterCard’s MasterPass Digital Wallet, continue to enter the marketplace on an almost daily basis. Now Samsung Pay promises to be one of the most versatile. Samsung Pay leverages NFC, MST, fingerprint verification and digital tokenization, all of which support quick and secure mobile payments. Samsung Pay enables consumers to utilize mobile devices and the evolving mobile payment options at existing POS terminals.

Meanwhile, a new proprietary technology called Magnetic Secure Transmission (MST) enables consumers to use Samsung Pay in merchant locations regardless of whether the terminals support NFC or a traditional magnetic strip, which includes the vast majority of existing terminals. Not only does this bridge the gap between speedy integration and consumer adoption, it also requires no retailer capital expenditure (CAPEX) investment. Samsung Pay is already live in the US, UK and South Korea.

The integration of mobile payment products clearly will drive transaction volume over the next several years. During the 2015 holiday shopping season however, retailers should use mobile payments as an opportunity to drive loyalty, repeat visits, gain wallet share and differentiate their brands during the industry’s most critical sales period.